Table of Contents

Understanding the Different Types of Insurance Adjusters

When it comes to filing an insurance claim, the role of an insurance adjuster is pivotal in ensuring that the process runs smoothly and that the settlement is fair. However, not all insurance adjusters are the same. They have different roles and responsibilities, depending on whom they represent and the nature of the claim. Let’s delve into the various types of insurance adjusters and understand their unique roles in the claims process.

1. Staff Adjusters

Staff adjusters are insurance adjusters employed directly by insurance companies. They handle claims exclusively for the insurer that employs them. Their primary goal is to save as much money as possible for the insurance company.

Roles and Responsibilities:

- Investigating claims on behalf of the insurer.

- Evaluating the extent of the insurance company's liability.

- Negotiating settlements with policyholders.

- Processing and approving claim payments.

2. Independent Adjusters

Independent adjusters work on behalf of insurance companies but are not direct employees. They are typically hired on a contract basis for specific claims or during peak times, such as after natural disasters. Like staff adjusters, their main objective is to minimize the payout from the insurance company.

Roles and Responsibilities:

- Conducting investigations and inspections.

- Assessing damages and determining the extent of the insurer's liability.

- Reporting findings to the insurance company.

- Negotiating and settling claims with policyholders.

3. Public Adjusters

Public adjusters, such as Home Claim Advocates, are insurance adjusters hired by policyholders to represent their interests in the claim process. They work exclusively for the policyholder, not the insurance company, making them the only insurance adjusters who look out for the policyholder's best interests. Public adjusters are usually paid on contingency, meaning there are usually no upfront costs; they get paid a percentage of the settlement amount.

Roles and Responsibilities:

- Evaluating and documenting the extent of the policyholder’s loss.

- Handling all communications with the insurance company.

- Negotiating the claim settlement on behalf of the policyholder.

- Ensuring that the policyholder receives the maximum payout possible under their policy.

Additional Benefits of Public Adjusters:

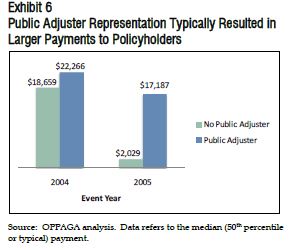

- Maximize Settlements for Policyholders: Public adjusters work tirelessly to ensure that policyholders receive the highest possible settlement for their claims. In fact, the Office of Program Policy Analysis and Government Accountability found that policyholders who used public adjusters received an estimated $9,379 on their claim compared to $1,391 for those policyholders that did not use a public adjuster, a difference of 574%.

- Time-Saving: Public adjusters handle all the time-consuming tasks related to the claim process, allowing policyholders to focus on other priorities. By meticulously documenting losses and presenting a compelling case to the insurance company, public adjusters aim to maximize the payout, providing significant financial relief to the policyholder.

- Stress Reduction: Dealing with an insurance claim can be stressful, especially after a loss. Public adjusters take on the burden of managing the claim, reducing stress for the policyholder. They understand the nuances of insurance policies and leverage their expertise to identify all eligible damages, often uncovering aspects of the policy that the policyholder might not be aware of, ensuring nothing is left unclaimed.

- Detailed Documentation: Public adjusters meticulously document every aspect of the claim, which can be crucial if there are any discrepancies or disputes later on. They work tirelessly to ensure that policyholders receive the highest possible settlement for their claims by presenting a compelling case to the insurance company.

- Comprehensive Claim Preparation: They ensure that every detail is covered and nothing is overlooked, which can significantly impact the outcome of the claim. This includes understanding the nuances of insurance policies and leveraging their expertise to identify all eligible damages.

Conclusion

Each type of insurance adjuster plays a crucial role in the insurance claims process. While staff adjusters and independent adjusters work for the insurance company and aim to save as much money as they can for the insurer, public adjusters are dedicated to representing the policyholder's interests and securing the best possible settlement.

If you're facing an insurance claim, it's essential to understand the different insurance adjusters involved and how they might impact your claim. Public adjusters, like those at Home Claim Advocates, can provide invaluable assistance by ensuring that your interests are represented throughout the claims process.

Reach out to Home Claim Advocates today to help you through a claim, double-check a claim, or get a free policy coverage review before disaster strikes. With expert guidance, you can navigate the claims process more confidently and secure the settlement you deserve.

Navigating the complex world of insurance claims can be daunting, especially when dealing with the aftermath of a significant loss. Insurance adjusters can either work to save the insurance company money or to ensure that you, the policyholder, get the settlement you deserve. Public adjusters stand out because of their commitment to the policyholder's best interests. By hiring a public adjuster, you ensure that you have a professional advocate on your side who understands the intricacies of the claims process and works tirelessly to secure a fair and just settlement for you. Whether it's through meticulous documentation, expert negotiations, or handling disputes, public adjusters provide a level of support and expertise that can make a significant difference in the outcome of your insurance claim. Don't leave your claim to chance—contact Home Claim Advocates today for expert assistance and peace of mind.

Furthermore, it's important to stay informed about the claims process and understand your policy thoroughly. By doing so, you can make informed decisions and be prepared for any eventualities. Public adjusters not only help you navigate the complexities of your claim but also educate you about your policy, ensuring you know your rights and entitlements. This proactive approach can make a significant difference in the event of a future claim, providing peace of mind and financial security. Whether you have a small claim or a complex one, having a knowledgeable public adjuster by your side can significantly impact the outcome.